4 August 2023,06:20

Daily Market Analysis

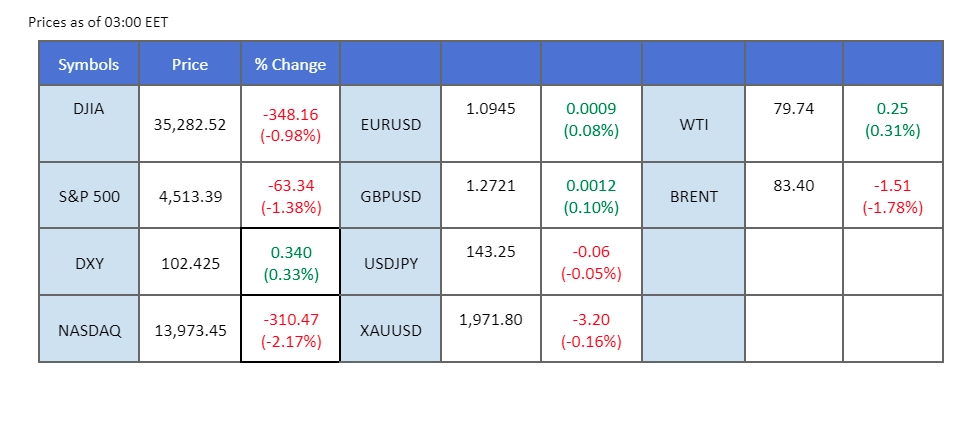

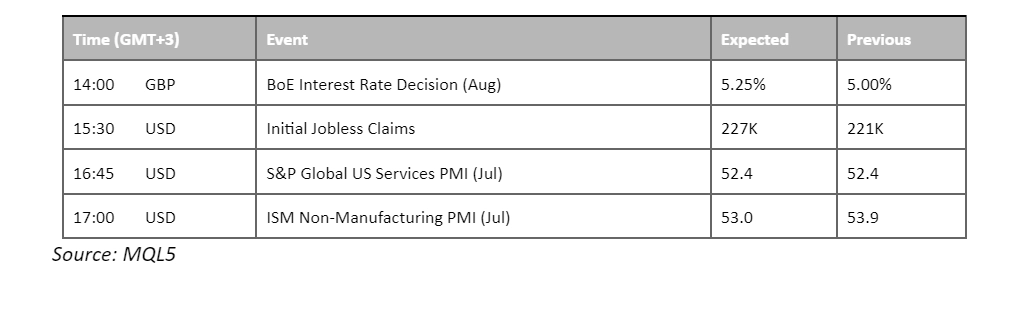

The dollar’s ascent of nearly 1% in August was further bolstered by the U.S. credit rating downgrade, pushing it close to the $103 threshold. However, yesterday U.S. economic data has tempered its surge, with PMI readings and labour costs indicating signs of easing, exerting downward pressure on the dollar. Meanwhile, the Bank of England (BoE) made a widely anticipated move by delivering a 25 bps rate hike, with the BoE governor emphasising that the policy will remain tight due to the U.K.’s inflation still being distant from its targeted rate of 2%. The market focus now turns to the eagerly anticipated U.S. Nonfarm Payroll data set to be released later today. Any figures surpassing 200k could prove to be a bullish catalyst for the dollar.

Current rate hike bets on 26th July Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (0.2%) VS 25 bps (99.8%)

The US Dollar traded slightly lower amidst downbeat economic data. The Department of Labor reported a marginal uptick in the number of Americans filing new claims for unemployment benefits last week, while the US services sector exhibited a slowdown in July due to businesses grappling with higher input prices, despite sustained demand. As for now, investors are keenly focused on forthcoming Nonfarm Payroll and unemployment rate data, scheduled to be released later today.

The dollar index is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 57, suggesting the index might extend its losses toward support level since the RSI retraced sharply from overbought territory.

Resistance level: 102.60, 103.45

Support level: 102.05, 101.45

Gold price witnessed a back-and-forth movement around a crucial support level as investors continued to await further catalysts before taking decisive positions in the market. The overall outlook for gold remained uncertain, despite expectations of increased safe-haven demand triggered by the downgrading of US government bonds. However, the optimism expressed by US policymakers regarding the nation’s economy tempered the appetite for safe-haven assets, leaving investors cautious.

Gold prices are trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 39, suggesting the commodity might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 1945.00, 1970.00

Support level: 1930.00, 1910.00

As the market anticipates the release of the U.S. Nonfarm Payroll later today, the dollar has softened from its recent peak of around $102.78. The dollar’s upward trajectory was hindered by yesterday’s U.S. economic data, which indicated signs of potential easing in inflation in the near term. Both the non-manufacturing PMI and unit labour cost fell short of the forecasted numbers. On the other hand, the Japanese Yen is expected to trade lower against other currencies as the Bank of Japan (BoJ) maintains its ultra-loose monetary policy. This policy stance continues to exert downward pressure on the Japanese Yen.

The USD/JPY failed to break another psychological resistance level at 144.00 and the indicators showed signs of easing in its bullish momentum. The RSI declines slightly before breaking into the overbought zone while the MACD has a cross above the zero line.

Resistance level: 143.15, 144.75

Support level: 141.88, 141.00

In August, the Canadian dollar staged a remarkable rebound, registering an impressive surge of nearly 1.5% so far. This robust performance can be attributed primarily to the bullish trend in oil prices. Notably, oil prices have displayed strength since July, primarily due to global supply cuts led by the OPEC+ alliance. However, the recent strengthening of the U.S. dollar may exert pressure on the Canadian dollar to trade higher.

The Canadian dollar has formed a double top price pattern at near 1.3380 which has the implication of a downtrend. The RSI has also dropped out of the overbought zone while the MACD has crossed, supporting the view of a trend reversal.

Resistance level: 1.3436, 1.3551

Support level: 1.3320, 1.3215

Pound Sterling rebounded from its lower level following the tightening monetary policy decisions from the central bank. The Bank of England (BoE) has taken a hawkish stance, raising its interest rates for the 14th time on Thursday, reaching levels not seen since early 2008. The central bank signalled that borrowing costs are likely to remain high for an extended period due to persistently high inflation. However, despite the BoE’s hawkish policies, investors remained sceptical, leading to significant selloff in Pound sterling. This scepticism is underpinned by the broader global trend of central banks, including the Federal Reserve, signalling a gradual shift towards more dovish policy decisions

GBP/USD is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 44, suggesting the pair might extend its gains toward resistance level.

Resistance level: 1.2778, 1.2888

Support level: 1.2655, 1.2550

US equity market edged lower after a chopping trading session, as investors weighed another rise in Treasury yields ahead of several crucial economic data and earnings. The benchmark US 10-year Treasury yield rose as high as 4.198%, hitting the highest level since November, extending its bullish momentum following Fitch’s downgrade of the top-tier US credit ratings

S&P 500 is trading lower following the prior retracement from the resistance level. MACD has illustrated increasing bearish momentum, while RSI is at 41, suggesting the index to extend its losses since the RSI retraced sharply from overbought territory.

Resistance level: 4605.00, 4790.00

Support level: 4380.00, 4205.00

The euro’s decline came to a halt as the market eagerly awaited the release of the highly anticipated Nonfarm Payroll (NFP) data. Investors are closely referencing the ADP Nonfarm employment data, which was released last Wednesday and indicated a still-tight labour market. This data is being used to gauge the NFP data before its release today. Notably, yesterday’s release of U.S. economic data, including the Non-manufacturing PMI and the unit labour cost, pointed towards potential easing in the country’s inflation. As a result, the dollar softened in response to this information.

Euro successfully rebound on its crucial support level at 1.0930. The RSI showed gaining in buying power while the MACD crossed above the zero line suggest the bullish momentum is forming.

Resistance level: 1.0998, 1.1090

Support level: 1.0930, 1.0845

Oil prices maintained their upward trajectory, buoyed by measures taken by Saudi Arabia and Russia to keep supplies tight throughout September and possibly beyond. Saudi Arabia announced its decision to extend a voluntary oil output cut of one million barrels per day (bpd) for a third consecutive month, including September, and hinted at further extensions. In tandem, Deputy Prime Minister Alexander Novak confirmed Russia’s commitment to cutting oil exports by 300,000 bpd in September.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 60, suggesting the commodity might extend its gains since the RSI stays above the midline

Resistance level: 83.20, 86.10

Support level: 78.90, 74.45

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment