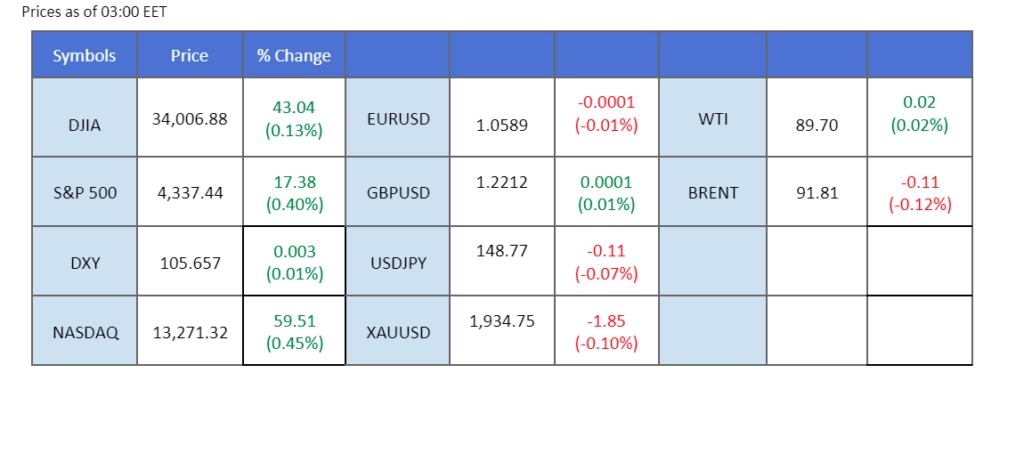

In the global markets, prevailing macroeconomic concerns persist, even as U.S. equity markets managed modest gains in their recent session. Notably, hedge funds and retail investors are unwinding stock leverage at a pace unseen since the 2020 pandemic crisis on Wall Street, stoking pessimism regarding the global economic outlook. This sentiment extends to the oil market as well, where prices have relinquished their bullish momentum due to the overarching macroeconomic headwinds. In addition, there are concerns that the Federal Reserve will maintain higher interest rates for an extended duration and hinder oil prices. Meanwhile, investor attention is keenly directed towards releasing Japan’s core CPI today. This data will be instrumental in assessing the strength of the Japanese yen.

Current rate hike bets on 1st November Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (68.0%) VS 25 bps (32%)

The Dollar Index continues its relentless ascent, marking a pinnacle not seen since November. Investors are bracing themselves for the looming specter of further interest rate hikes by the Federal Reserve in their upcoming monetary policy meeting. The Fed’s previous guidance suggested the possibility of a quarter-point rate hike by year-end, contingent upon persistent inflation rates surpassing expectations, which currently stand at a formidable 3.70%, still above the Fed’s 2% target.

The Dollar Index is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 67, suggesting the index might enter overbought territory.

Resistance level: 106.25, 107.05

Support level: 105.40, 104.25

Gold prices have slipped as the Dollar reaches its highest point in ten months, propelled by the Federal Reserve’s recent warning that US interest rates are poised to remain elevated for an extended duration. A resurgent Dollar tends to deter investment in dollar-denominated commodities, including the precious metal, thus contributing to its decline.

Gold prices are trading lower following the prior breakout below the previous support level. MACD has illustrated increasing bearish momentum, while RSI is at 40, suggesting the commodity might extend its losses since the RSI stays below the midline.

Resistance level: 1930.00, 1950.00

Support level: 1900.00, 1885.00

The euro is poised for its 11th consecutive week of losses as the dollar index surges beyond $106, a level not seen since last December. The unwaveringly hawkish stance from the Federal Reserve has led the market to anticipate an extended period of elevated interest rates, strengthening the dollar against its counterparts. In contrast, the eurozone’s sluggish job growth and weakened economic activity do not provide a conducive environment for the European Central Bank (ECB) to pursue an aggressive monetary tightening policy. This divergence in central bank policies further underscores the euro’s challenges in the current market dynamics.

EUR/USD continues to trade with a strong bearish momentum. The RSI is on the brink of breaking into the oversold zone while the MACD continues declining, suggesting the bearish momentum is strong.

Resistance level: 1.0638, 1.0700

Support level: 1.0540, 1.0460

The GBP/USD pair is entrenched in a pronounced bearish trend, having declined by almost 7% since its mid-July peak. This decline is attributed to the widening gap in interest rate differentials between the central banks of both countries. The unexpected rate pause by the Bank of England (BoE) contrasts with the potential rate hike anticipated from the Federal Reserve in November, leading to a bearish sentiment surrounding the Cable.

GBP/USD is trading in a strong bearish momentum and has declined sharply after forming a bearish engulfing candlestick pattern. The RSI has broken into the oversold zone while the MACD continues to slide, suggesting a strong bearish momentum.

Resistance level: 1.2310, 1.2400

Support level: 1.2200, 1.2110

The Australian dollar has displayed remarkable resilience against the backdrop of a strengthening U.S. dollar, which has propelled the dollar index to its highest level since last December. The market’s current uncertainty revolves around whether the Reserve Bank of Australia (RBA) will proceed with its anticipated rate hike next Monday. While Australian economic data has surpassed expectations, global macroeconomic headwinds may deter the RBA’s decision to continue its rate hike cycle.

The AUD/USD pair is trading sideways in a wider range between 0.6500 and 0.6400. The RSI flows near to the 50-level while the MACD hovers around zero line; both indicators give a neutral signal for the pair.

Resistance level: 0.6500, 0.6610

Support level: 0.6390, 0.6280

Despite a minor rebound fueled by bargain hunting, the US equity market remains ensnared in a negative trajectory. The primary catalyst for this bearish stance stems from the surge in the US 10-year yield, now at its loftiest level since 2007. Rising yields put pressure on US stocks by increasing borrowing costs, which can hurt company profits and make stocks less appealing to investors.

The Dow is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 37, suggesting the index might enter oversold territory.

Resistance level: 34355.00, 34900.00

Support level: 33720.00, 32990.00

USD/JPY has scaled an 11-month zenith, courtesy of the yield differential between the Japanese yen and the resurgent US Dollar. This stark contrast emerged following the Federal Reserve’s signal that it may raise interest rates further, which directly contradicts the Bank of Japan’s persistent quantitative easing policies. Nonetheless, traders betting against the yen must remain cautious of potential currency interventions. The Japanese Ministry of Finance issued a stern warning to currency speculators, hinting at imminent intervention should the yen’s depreciation persist.

USD/JPY is trading higher following the prior breakout above the previous resistance level. However, MACD has illustrated diminishing bullish momentum, while RSI is at 65, suggesting the pair might enter overbought territory.

Resistance level: 150.25, 151.45

Support level: 148.50, 146.25

Oil prices have retracted in response to two key factors: Russia’s relaxation of its fuel export restrictions and the resurgent US Dollar. Russia recently approved amendments to its fuel export ban, lifting constraints on specific fuel categories such as bunkering for vessels and high-sulphur diesel. Concurrently, the revived strength of the Dollar has eroded the appeal of dollar-denominated oil, further contributing to the decline in prices.

Oil prices are trading lower while currently near the support level. MACD has illustrated increasing bearish momentum, while RSI is at 46, suggesting the commodity will extend its losses after breakout since the RSI stays below the midline.

Resistance level: 92.45, 95.80

Support level: 88.50, 84.45

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

新註冊暫停

我們目前暫不接受新的註冊。

雖然目前無法接受新註冊,但現有用戶仍可照常進行挑戰和交易活動。