1 June 2023,05:57

Daily Market Analysis

The House of Representatives has successfully passed a debt ceiling deal to prevent a potentially catastrophic event. However, the process is not yet complete as the bill now awaits approval from the Senate, where not all senators are satisfied with the bipartisan agreement. The equity markets were negatively affected by better-than-anticipated job data, as it raises the possibility of a more aggressive rate hike by the Federal Reserve. Nevertheless, a Federal Reserve official subsequently hinted at a potential pause in June to assess the state of the economy before making any decisions. Meanwhile, oil prices continue to decline due to the sluggish economic recovery in China. Investors are closely monitoring the UK’s PMI (Purchasing Managers’ Index) and the Eurozone’s CPI (Consumer Price Index) to gauge the price movement of the British Pound and the euro respectively.

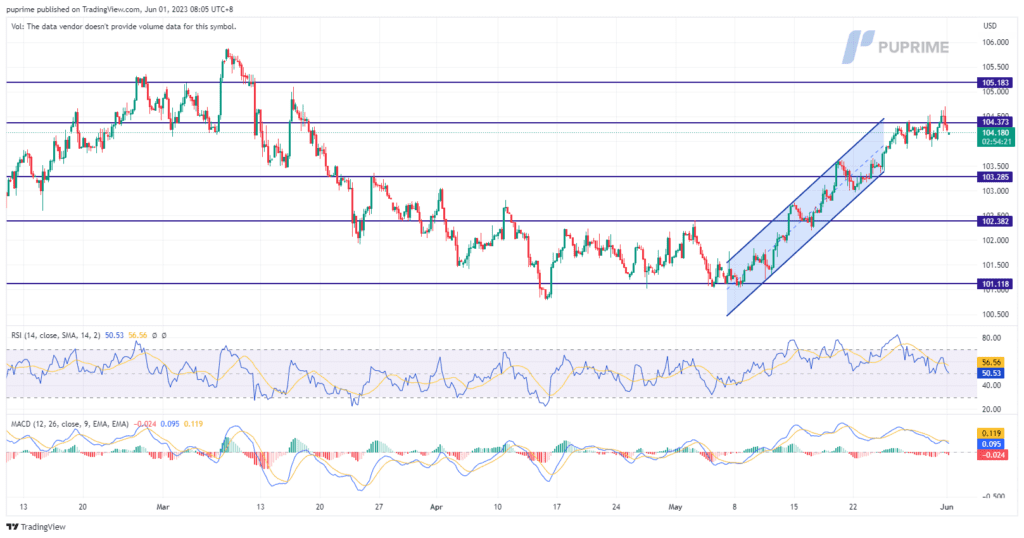

Current rate hike bets on 14th June Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (62%) VS 25 bps (38%)

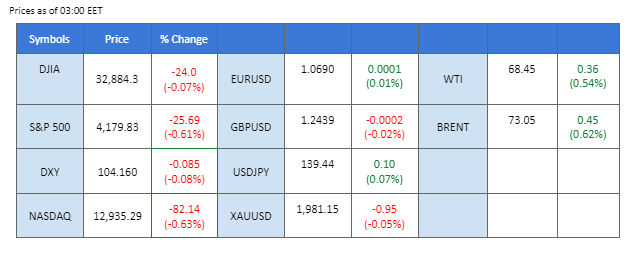

The U.S. dollar witnessed a rise in value following the release of strong JOLTS (Job Openings and Labor Turnover Survey) data. The report for April indicated a significant increase in job openings to 10.103M, surpassing market expectations of 9.775M and signalling a robust labour market. This positive data bolstered investor confidence in the U.S. economy, leading to increased demand for the dollar as traders anticipated a potentially more hawkish stance from the Federal Reserve in response to the improving labour market conditions.

The U.S. dollar continues to maintain its bullish momentum, and traders are advised to focus closely on today’s economic data as it is likely to impact further price movements.

Resistance level: 104.40, 105.20

Support level: 103.30, 102.40

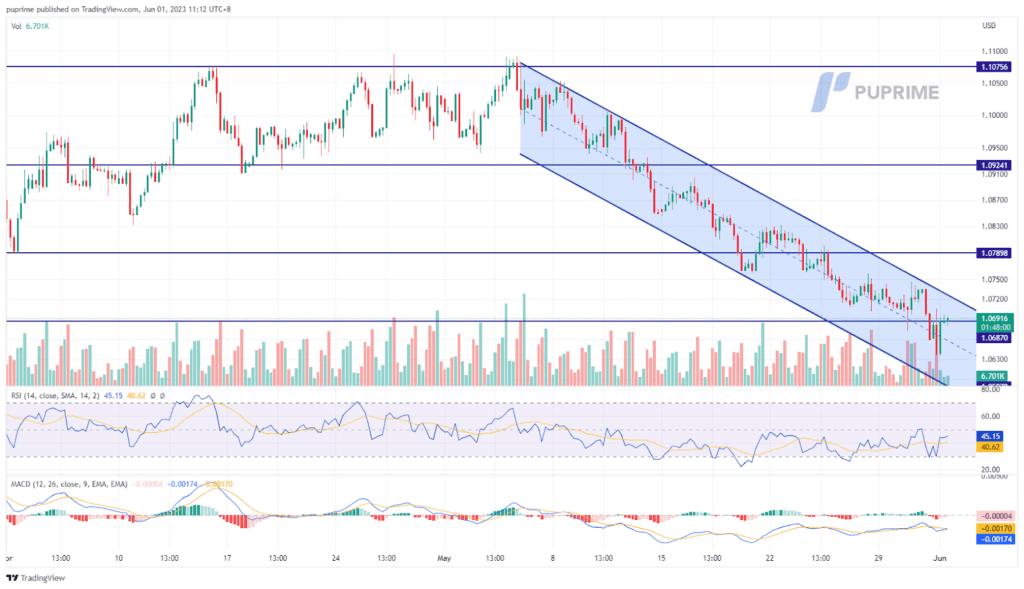

Gold is trading higher to $1966 against the dollar on Wednesday. As for now, a breakdown below the $1900 level could lead to significant downward pressure. If this level is breached, it may signal a potential market downturn and a further decline in gold prices. On the other hand, if the market manages to break above the $2100 level, it could trigger a strong upward movement for gold. It is crucial to approach these scenarios with a neutral viewpoint, carefully monitoring price movements and debt ceiling deals to make informed trading decisions.

From a technical standpoint, the MACD suggests a potential bullish crossover, indicating a shift towards upward momentum. Additionally, the RSI displays a bullish divergence or a possible upward reversal. These technical signals imply a cautious optimism for gold in the near term. However, it is essential to consider other factors, such as market sentiment and fundamental drivers, before making any trading decisions.

Resistance level: 1980.00, 2005.00

Support level: 1950.00, 1915.00

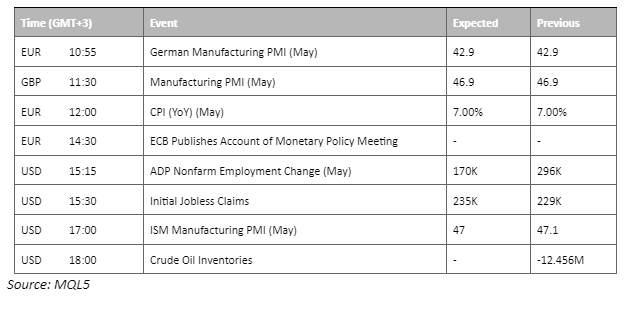

The easing of the strong dollar prevented the euro from dropping further; however, the pair is still trading in a bearish channel. The dollar went sideways after the Fed vice chair nominee signalled to pause the rate hike in June amid the debt limit crisis in the U.S. On the other hand, the euro continues to be sluggish as softer-than-expected inflation data are recorded in several European countries. Investors are now waiting for the Euro’s CPI to gauge the price movement of the pair despite it is almost certain that the ECB is going to raise 25 bps of interest rate in June.

The euro continues to trade within the downtrend channel despite the recent dollar easing. The indicators provide a neutral-bearish signal as the RSI hovers in a small range just above the oversold zone while the MACD flows flat below the zero line.

Resistance level: 1.0789, 1.0924

Support level: 1.0588, 1.0537

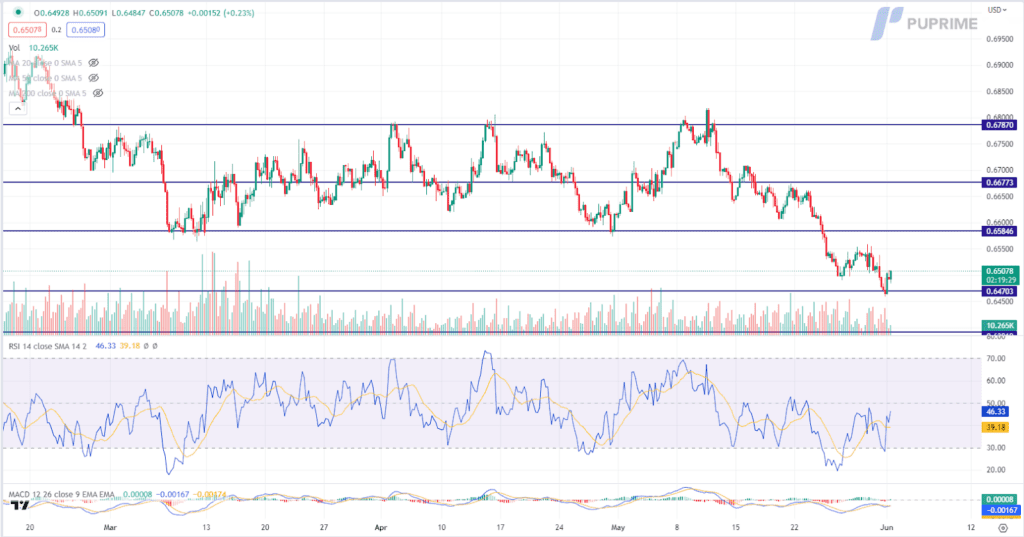

The Australian Dollar experienced a strong rebound in the early Asian financial market, buoyed by the release of highly positive economic data from its major trade partner, China. China’s Caixin Manufacturing Purchasing Managers Index (PMI) exceeded market expectations, surging from 49.5 to an impressive 50.9, indicating a shift from contraction to expansion in the manufacturing sector. This robust data instilled confidence in global markets, driving investors to embrace riskier assets such as the Australian Dollar, which benefited from the improved outlook for trade and economic cooperation between the two nations.

AUD/USD is trading higher following the prior rebound from the support level. MACD has illustrated increasing bullish momentum, while RSI is at 46, suggesting the pair might extend its gains toward resistance level.

Resistance level: 141.65, 145.50

Support level: 138.95, 136.25

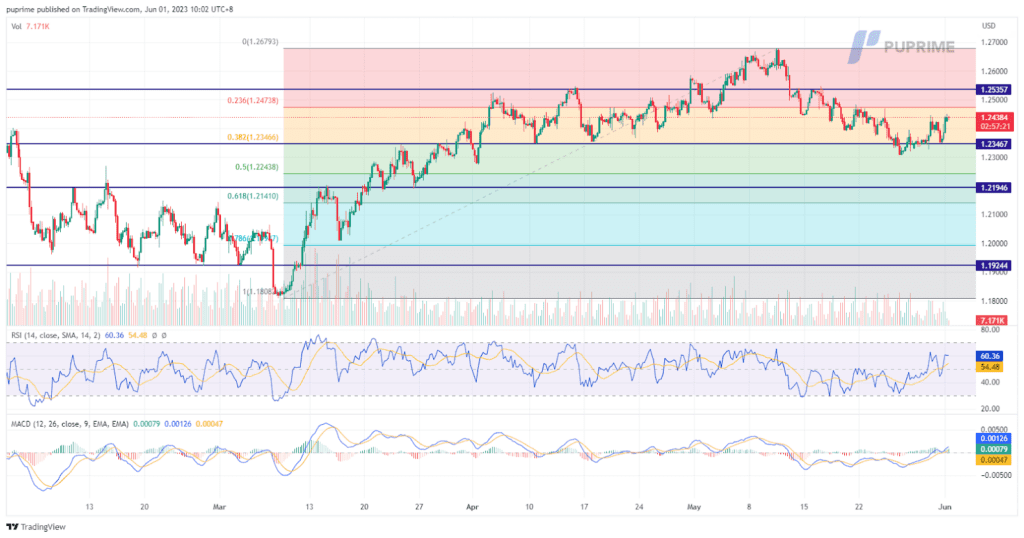

The British pound made significant gains against the US dollar, supported by stabilization in the UK government bond market after a notable sell-off triggered by higher-than-expected inflation figures. Recent attempts to rebound further strengthened the pound’s position. Investors are advised to focus on today’s manufacturing PMI data, as it can provide additional trading signals and insights into the performance of the UK manufacturing sector, which may influence the pound’s value in the market.

The pound is showing signs of attempting to rebound, suggesting a potential shift in the overall trend towards a slightly bullish sentiment. However, it is important to monitor further economic data to confirm and assess the strength of this potential rebound.

Resistance level: 1.2495, 1.2574

Support level: 1.2281, 1.2214

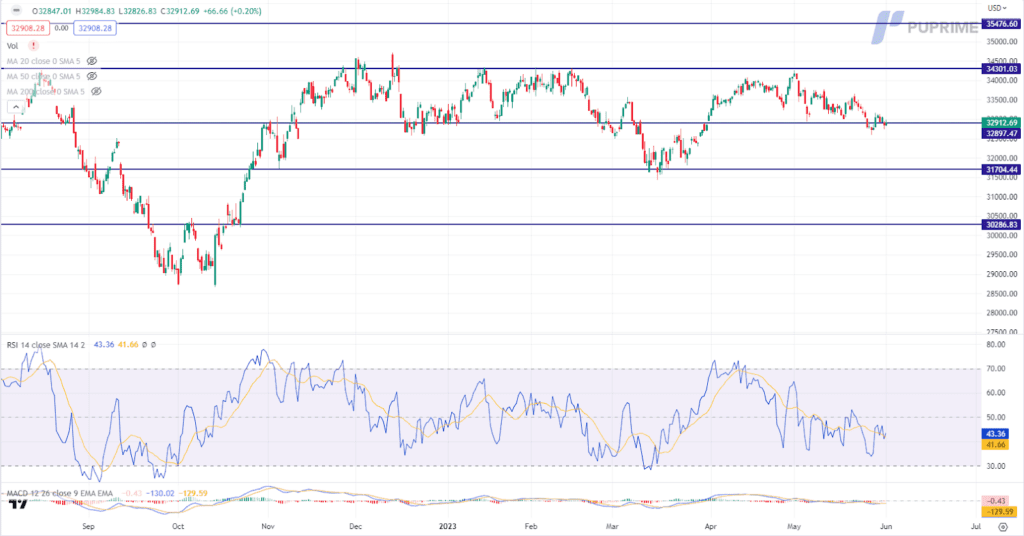

Despite positive developments in the House regarding debt ceiling negotiations, the Dow edged lower as unexpectedly strong labor market data rattled investors who now fear a potential interest rate hike by the Federal Reserve in June. The US JOLTs Job Openings for April surpassed market expectations, coming in at 10.103 million compared to the projected 9.775 million. While the House of Representatives took a procedural step with a 241-187 vote to consider the debt ceiling measure, the bill’s journey through the Senate introduced ongoing market volatilities. With a cautious stance, investors will closely monitor upcoming crucial US job data, including the Nonfarm Payroll and unemployment rate, set to be released on Friday.

The Dow is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 43, suggesting the index might experience technical correction since the RSI rebounded sharply from oversold territory.

Resistance level: 34300.00, 35475.00

Support level: 32895.00, 31705.00

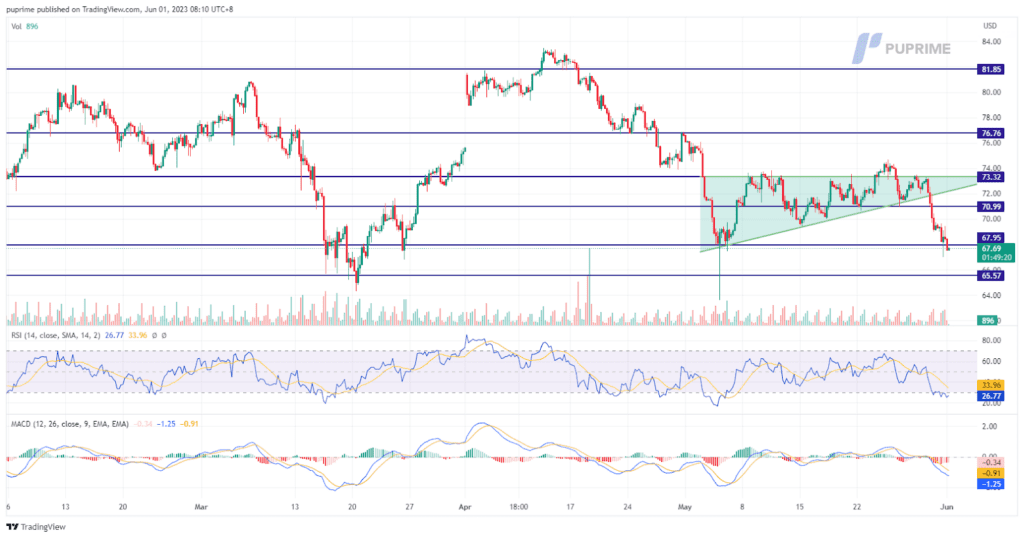

Oil prices experienced a slump, falling to $67 due to the release of China’s manufacturing PMI data, which came in significantly lower than expectations. This disappointing data has contributed to an overwhelmingly bearish sentiment in the market, with limited risk appetite among traders. The upcoming OPEC+ meeting adds to the cautious outlook as market participants await potential decisions impacting oil production levels and supply dynamics. Additionally, investors are advised to focus closely on today’s crude oil inventories data release.

Oil prices have breached the key support level of $68, indicating a continuation of the bearish sentiment in the market. The overall outlook remains weak, suggesting that the downward momentum may persist. However, a slight technical rebound is possible as the RSI has already entered the oversold zone.

Resistance level: 71.00, 73.30

Support level:65.55, 61.80

Trade forex, indices, cryptocurrencies, and more at industry-low spreads and lightning-fast execution.

12 December 2023, 05:38 All Eyes On U.S. CPI Reading

11 December 2023, 05:23 Dollar Surges On Exceptional Jobs Data

8 December 2023, 05:50 Yen Rallies On BoJ Hawkish Comment

新註冊暫停

我們目前暫不接受新的註冊。

雖然目前無法接受新註冊,但現有用戶仍可照常進行挑戰和交易活動。